World trade and tariffs are complicated. Dirt bikes are not. Enter the diminutive Hodaka motorcycle.

Back in the ‘60s an Athena, Oregon grain exporter had a problem. The Pacific Basin Trading Company, PABATCO, was selling lots of grain to Japan. The were accumulating piles of Japanese Yen in return. A way was needed to convert this currency into dollars while making a profit.

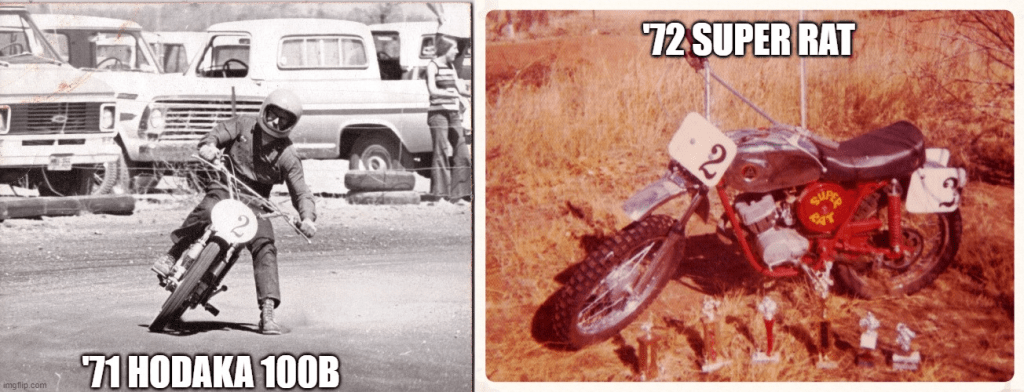

As the story goes, a PABATCO executive who happened to be a dirt bike rider had an idea. He had been observing a revolution in the off-road motorcycle industry. The big four-stroke British machines that had once dominated off-road racing were giving way to lighter, faster, more agile two-stroke bikes from European marques like Husqvarna, Maico and Bultaco. Though the Japanese made great motorcycles, they had yet to come up with a competitive dirt bike.

He sketched out an idea for a small dirt bike on a napkin. Its main feature was a sturdy, double loop cradle frame that protected the engine. He checked with his contacts in Japan. Could they build it? The answer was yes.

HodaKA, A Japanese machine tool maker already had a successful engine. It was very compact, with an innovative ball bearing and spring shifter mechanism. The engine was light and powerful. The PABATCO-designed frame provided excellent balance and handling. The little bike that resulted from this collaboration was a terror in the dirt. It’s first dedicated racing model was called the Super rat. It could outrun much larger machines. It was a win/win for PABATCO and Hodaka.

The folks who are screaming the loudest about tariffs and trade deficits could learn a lot from the PABATCO/Hodaka success story. The goal in world trade should be to establish long-term relationships that benefit both parties. Ideally, the value of a nation’s exports should equal the cost of its imports. If it doesn’t, there are other mechanisms to balance out the differences. The country with the surplus balance could simply buy more for the other country. It could also invest its surplus in the other country. America’s trading partners buy real estate, build factories, and invest in our securities. That makes some Americans nervous.

Tariffs are often proposed as the solution to trade imbalances and as a way of increasing government revenues. This is a slippery slope to follow. George III famously tried to impose a tea tax (tariff) on his colonial subjects. The colonists rejected the tariff along with George’s rule over them. Napoleon’s “Continental System” was another failure of tariffs. He wanted to lock England out of trade with the European continent. Smuggling became rampant. Napoleon’s protectionism failed to make France wealthy and self-sufficient. It caused wars in the Iberian Peninsula and with Russia. Rather than benefitting France, the system impoverished it. Meanwhile, England increased its trade with Spain, Portugal, and their colonies. America, exasperated by the seizure of its sailors and cargoes by the belligerents, enacted and embargo on trade with the warring parties. The embargo was one of the underlying causes of the War of 1812.

It is true that much of America’s early revenue resulted from tariffs. We did not enact our first income tax until the Civil War. After the war, tariffs continued to be a major source of revenue. Working-class Americans saw these tariffs as placing too much of the burden of taxation on them. As a result, the 16th Amendment which authorized the current income tax was ratified in 1913. America continued to rely on tariffs, but gradually shifted the burden of taxation toward the progressive income tax. In 1930, Congress reversed that trend by passing the Smoot-Hawley Tariff Act. Economists no say the tariffs exacerbated and prolonged the Great Depression.

Today, tariff advocates are once again claiming that tariffs will solve all of America’s problems. They claim if we impose new tariffs, factories building the cheap products we now buy overseas will spring up all over the land! Really? How long does it take to plan and build an iPhone factory? Can we find skilled workers to build them for $7.25 an hour? Who among us is willing to pay $3000 for the phones they produce? Granted, some industries are so vital that they need some protection. This may be better accomplished by subsidizing them. The bi-partisan CHIPS Act was a step in the right direction. Unfortunately, it appears to be in jeopardy for largely political reasons.

Not everyone understands that tariffs are a tax on ordinary American consumers. Tariffs are not paid by the country of a product’s origination. They are paid by the US importer when the products arrive. Most, if not all, of this charge is passed on to the consumer. The tax is regressive, meaning that the lower your income, the higher percentage of it goes toward paying the tax on the things you need. The wealthier you are, the less percentage of your income goes to paying tariffs.

Tariffs also raise production costs for nearly all domestic products. Does your new Ford have tires with rubber from Malaysia? Will the new home you are building use lumber from Canada, light fixtures from India, or tile from Mexico? Can you even get those items in today’s market? How many factories will have to shut down due to unavailability of key materials from abroad?

The flip side of imposing tariffs is the inevitable imposition of punitive tariffs by other trading nations. This hurts American producers. One sector which suffers the most is agriculture. When tariffs are imposed on farm exports, our trading partners often look elsewhere to fulfil their needs. With no market for their crops farmers go bust. The last time we got in a trade war with China, they quit buying soy beans and pork from us. We had to bail out farmers with subsidies. It was a self-inflicted wound.

Perhaps the biggest hope of those advocating increased tariffs is that they can be used to pay off the national debt. Good luck with that. First, such an idea would shift more of the burden of taxation from those with high incomes to ordinary working-class Americans. That would have consequences in terms of their purchasing habits. The higher prices would inevitably lead them to buy less. This could, and likely will, result in a recession. Tariff revenue might just have to be used for relief of those whose livelihoods are disrupted by them.

In summary, tariffs are a tool that can be used to help or hurt our nation. Used unskillfully by a self-interested leader, they could cause much more harm than good. I am pretty sure that Donald Trump’s fat ass has never been on a Hodaka Super Rat. This innovative little machine once helped the farmers of the Pacific Basin find a sustainable market for their products. Trump would destroy the mutual benefits of world trade with his incompetent, ham-handed approach to tariffs.

OK, enough of my rant. I need to check to see how much I lost in my 401K today.

LDT April 18, ‘25

Main Menu- http://www.azrockdodger.com